- +91-9873192426

- bijender.attri007@gmail.com

- AMFI Registered Mutual Fund Distributor

A mutual fund is simply a financial intermediary that allows a group of investors to pool their money together with a predetermined investment objective.

Retirement saving is a crucial aspect of financial assessment, often emphasized as an important step to ensure a comfortable and enjoyable retirement.

Saving for a child’s future is a key aspiration for many parents, covering expenses from education to marriage. Starting to save early is crucial.

Income from any source such as salary, a business, rents, investments, and more is taxable. Tax saving is a practice of saving tax by making investment declarations.

FD or Fixed Deposits is an investment in which an individual invests a lump sum amount for a specific period with a company.

Portfolio management includes prioritizing, choosing the right investments, and strategising to achieve good returns. It simply refers to overseeing

Understanding how life insurance works and how to shop for a policy can help you find the best coverage to meet your family’s needs.

At BA Capital, we understand this better than most – the toil and sweat that goes into building/ buying a house and the subsequent pride and joy of owning one.

National Pension Scheme (NPS) is a government-backed retirement savings plan offering market-linked returns and tax benefits.

Invest in IPOs and trade shares to grow your wealth with smart market decisions. Open your trading account today, explore new opportunities

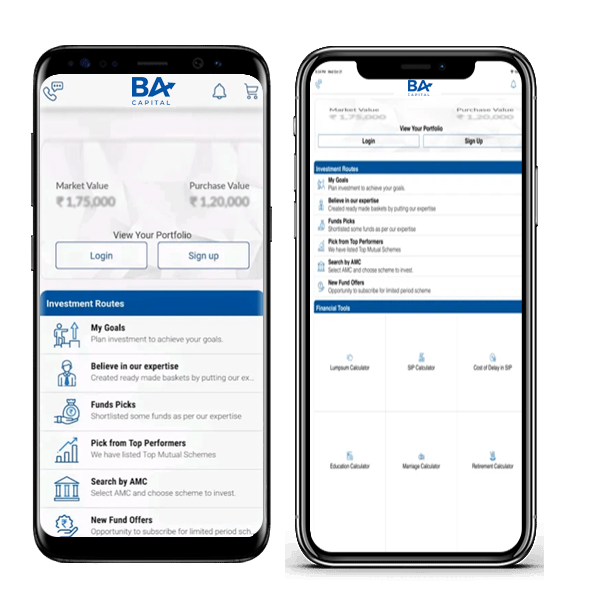

Access to hand picked list of selected funds

Invest in Mutual Fund schemes

Check your portfolio anytime anywhere

Financial planning may seem overwhelming to begin with, but our focused, goal-oriented approach and expertise put you in the driver's seat, and your wealth on the fastrack.

We make your portfolio work for you, by periodically reviewing allocation and performance with analytics. Working ahead of market trends, to make the most of its fluctuations.

The personalized approach, in-depth knowledge, proactive nature, and excellent client service have made BA Capital an invaluable partner in my financial journey. I am immensely grateful for their expertise and commitment to my financial well-being.

Lt Gen Rajinder Singh (V ) AVSM , VSM

I wanted to take a moment to thank you for your insightful guidance and support. I really appreciate your help with understanding my investment options, creating a budget]m and for taking the time to explain everything so clearly. Your advice has been invaluable, especially helping me feel more confident about my investments, giving me a clearer understanding of my finances.

Thank you again for everything.

BA Capital helped me create a clear, realistic retirement corpus. Their personalized approach gave me peace of mind for my future.

Saandiip Bhaatiaa Chief Marketing Officer - Polyplastics India Pvt. Ltd.

I started my SIP journey with BA Capital just four years ago, and I’m already seeing steady, disciplined growth. Their guidance made investing simple and stress-free.

Virat Jain Senior Manager - Amazon

The BA Capital team is knowledgeable, responsive, and truly cares about my goals. I feel more in control of my finances than ever before.

Ram Kishan Gupta President of SN Sidheshwar Sr. Sec. Public School

They helped us plan our children’s education fund through a goal-based SIP. We’re confident and stress-free about their future now.

DR. S.P. Yadav Urologist, MBBS, MS General Surgery, MCh Urology,

Even from thousands of miles away, I get timely updates and personalized advice. Mr. Attri truly understands NRI investment needs.

Rohit Kumar Partner - E & Y

I used to struggle with tax planning. Thanks to their strategic investment suggestions, I now save more and invest smarter every year.

Mrs. Santosh Kumari Lecturer in English, Govt. Of Haryana

Their approach isn’t just investment-centric—it’s holistic. From tax-saving to wealth transfer, BA Capital is my go-to financial partner."

Dr. Myush Ohri Specialist Consultant (ENT, HEAD, and NECK Surgery),

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

*Demat account is free for First year. Motilal Oswal is our trading partner.

AMFI Registered Mutual Funds Distributor | ARN-96681 | Initial Date of Registration: 13/07/2014 | Validity: 13/07/2026

©2025 BA Capital. Privacy Policy | Disclaimer | Disclosure | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors

As someone who has always been cautious about financial matters, I was looking for a trustworthy and knowledgeable partner to help me navigate the complexities of wealth management. I am delighted to say that I found exactly what I was searching for.

Rakesh Wadhwa Corporate Lawyer